Helping medium and high-risk clients improve the efficiency and profitability of their global payments processes through the movement, management and integration of digital and fiat assets.

Everything that can be tokenized, will be tokenized.

Damex creates digital asset experiences for businesses and individuals, in secure and regulated environments, that enhance their day-to-day operations and lives.

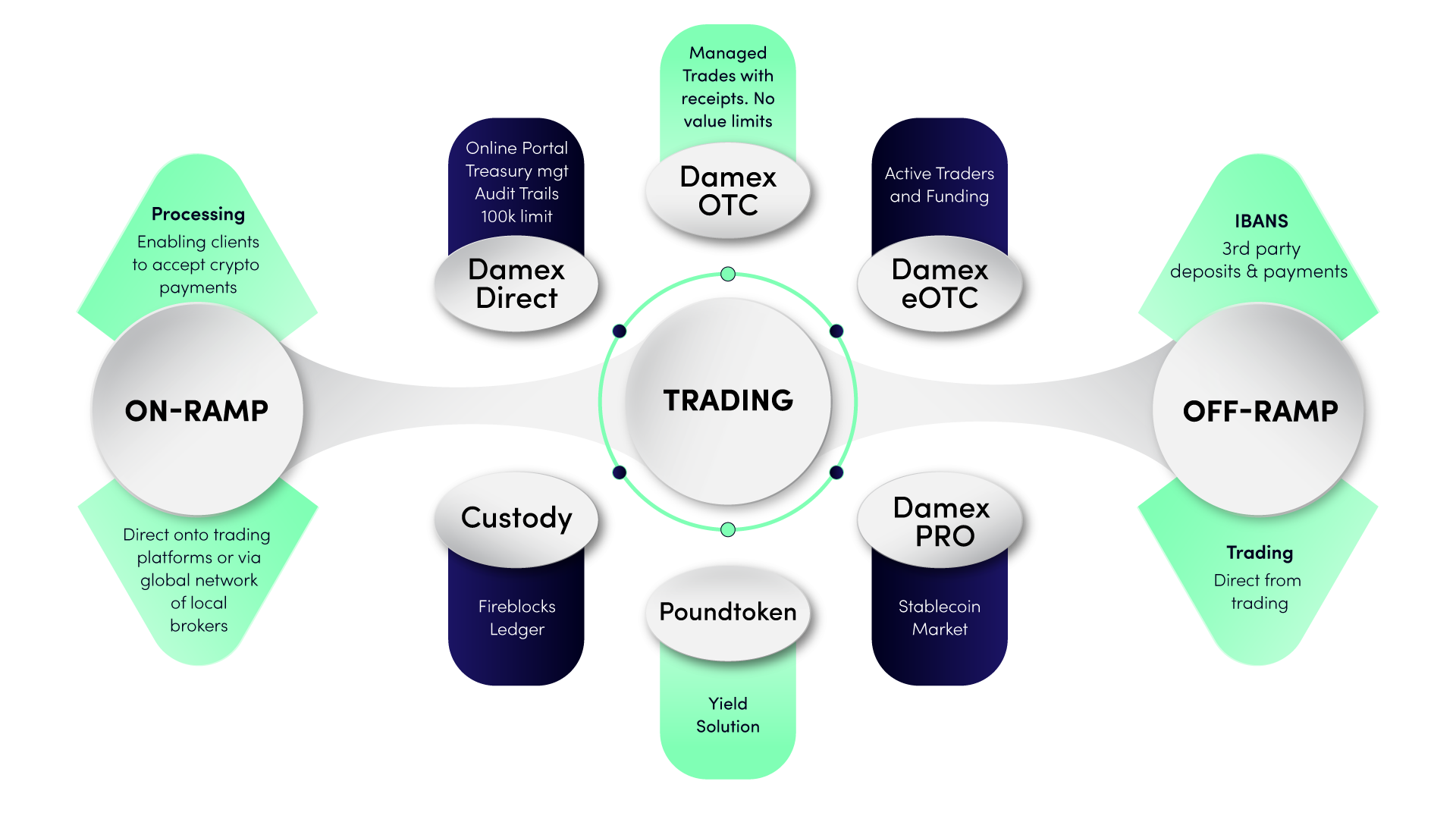

At the centre of the Damex Business operation is trading: the conversion and management of digital and fiat assets. Damex Business offers three different trading services:

We deliver a personalised service for digital assets investing where you can talk to your broker any time, getting the latest insights on digital assets trends and news when you need it.

Scott McKim

Co-Founder & Chief Operating Officer

Damex Business partners with global leading processors to enable clients to accept digital asset payments and deposits. Each solution is tailor-made to cater for the specific use-case.

Working with global experts means Damex

Business can provide best-of-breed, closed-loop solutions for every scenario.

Damex Business has also developed a Global network of local brokers which can facilitate conversions of local currencies into stablecoins.

These stablecoins can then be used for instant, safe cross-border transactions.

In addition, clients can simply purchase stablecoins directly through our OTC trading desk.

Damex Business can provide dedicated, named International Bank Account Numbers (IBANs) to any clients registered within the EU and EAA. This means clients can accept and make unlimited 3rd party payments in GBP or EUR.

The Damex OTC desk can also convert digital assets into fiat assets and settle into designated client fiat accounts.

Poundtoken is the first regulated GBP stablecoin issuer in the British Isles. The coin, previously known as GBPT, is now 1GBP.

For Damex clients, 1GBP offers the opportunity to generate monthly yield on assets held up to the equivalent of 3.5% per annum.

Any assets deposited with Damex can be automatically converted to 1GBP and yield accrues immediately.

Designed for stability, poundtoken is 100% backed by GBP held in segregated bank accounts by the Bank of England, so it’s always redeemable 1-to-1 for pounds sterling.

Poundtoken is audited by KPMG who issue quarterly assurance reports giving holders the peace of mind that poundtoken maintains its stable value.

Poundtoken holds a Money Transmission Services Licence issued by the Isle of Man Financial Services Authority.

The Damex Business partnership with Poundtoken / 1GBP is the first stage in the development of the Damex Business Rewards programme where, for the first time, Damex clients can earn rewards up to the equivalent of 3.5% per annum on assets held.

1GBP is issued by Poundtoken which is the first regulated GBP stablecoin issuer in the British Isles. Designed for stability, 1GBP is 100% backed by GBP held in segregated bank accounts by the Bank of England, so it’s always redeemable 1-to-1 for pounds sterling.

Any assets deposited with Damex can be automatically converted to 1GBP and yield accrues immediately.

Poundtoken is audited by KPMG who issue quarterly assurance reports giving holders the peace of mind that poundtoken maintains its stable value.

Poundtoken holds a Money Transmission Services Licence issued by the Isle of Man Financial Services Authority.

Damex offers three alternative custody solutions.

Our standard custodial partner is Fireblocks,who store and move over $200 billion worth of digital assets a month.

For more specialist scenarios, Damex is proud to be part of the groundbreaking Ledger Enterprise Tradelink network. The network supports institutions with an open, enterprise-grade platform that caters to their risk management and regulatory requirements.

Our final solution is the interest-bearing Poundtoken as detailed below.

Damex offers three alternative custody solutions.

Our standard custodial partner is Fireblocks,who store and move over $200 billion worth of digital assets a month.

For more specialist scenarios, Damex is proud to be part of the groundbreaking Ledger Enterprise Tradelink network. The network supports institutions with an open, enterprise-grade platform that caters to their risk management and regulatory requirements.

Our final solution is the interest-bearing Poundtoken as detailed below.

We’re a team of influential leaders experienced in revolutionising the digital asset market. Collectively offering a wealth of expertise within the Digital Asset, iGaming, and Payments spaces.

Co-Founder & CEO

Co-Founder & Chief Operating Officer

Chief Business Development Officer

Fill out the form provided.

We’ll get back to you as quickly as possible.

Purchasing and investing in Digital Assets is a high-risk activity which incurs risks which are not inherent in managing traditional financial instruments and other assets. The value of digital assets, other digital assets or fiat currencies is not indicative of future performance.

Digital Asset Management Limited is a Company registered in Gibraltar with registration number 116618, with registered business names and trading as ‘Damex’ and ‘Damex.io’. Damex is authorised by the Gibraltar Financial Services Commission (Licence Number 24738) as a Distributed Ledger Provider to provide custody solutions and broker/dealer services under the Financial Services Act. These services are separate and unrelated to the account and payment services you receive from Modulr FS Ltd. Digital Asset Management Limited is a registered EMD agent of Modulr FS Limited, a company registered in England and Wales with company number 09897919, which is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Firm Reference Number: 900573) for the issuance of electronic money and payment services. Your account and related payment services are provided by Modulr FS Limited. Your card is issued by Modulr FS Limited pursuant to a license by Visa Europe. Visa and the Visa brand mark are registered trademarks of Visa Europe.

Damex.io UAB is a joint stock company registered in the Republic of Lithuania (under company number 306148560), with registered address at Žygimanto Liauksmino str. 3, Vilnius, Lithuania and is registered by the State Enterprise Centre of Registers of the Republic of Lithuania as a provider of virtual currency exchange and virtual currency wallet provider. These services are separate and unrelated to the account and payment services you receive from Modulr Finance B.V . Damex.io UAB is a partner of Modulr Finance B.V., a company registered in the Netherlands with company number 81852401, which is authorised and regulated by the Dutch Central Bank (DNB) as an Electronic Money Institution (Firm Reference Number: R182870) for the issuance of electronic money and payment services. Your account and related payment services are provided by Modulr Finance B.V. Your card is issued by Modulr Finance B.V. pursuant to a license by Visa Europe. Visa and the Visa brand mark are registered trademarks of Visa Europe.

Your account and related payment services are provided by Modulr FS Limited, if you are registered in the UK, and by Modulr Finance B.V., if you are registered in the EU. Whilst Electronic Money products are not covered by the Financial Services Compensation Scheme (FSCS) your funds will be held in one or more segregated accounts and safeguarded in line with the Electronic Money Regulations 2011 (in the UK) and the Dutch Financial Supervision Act (Wet op het Financieel Toezicht, Wft) (in the EU). Click here to find out more.

The Damex application is presently undergoing testing and regulatory registrations in various jurisdictions. As a result, full public release and features of the application in your jurisdiction is subject to Damex’s permissions and authorisations.

Please also see our Risk Notice for further information.